Guide to configure and deploy an ERC3643 token

The T-REX platform facilitates the seamless issuance, allocation, and management of ERC-3643 tokens.

Importantly, you can modify compliance rules effortlessly throughout the token's lifecycle without the necessity of redeployment or smart contract migration. This flexibility ensures efficient token management while maintaining regulatory compliance, enhancing operational agility and security.

Warning: Compliance modules are only compatible with TREX v4 tokens and subsequent versions.

Note: Learn more about the Standard for RWA Tokenization in the ERC-3643 official website.

Create an ERC-3643 token

The T-REX token implementation of the ERC-3643 protocol ensures robust security with its integrated checks and decentralized identity framework, ONCHAINID. This tool guarantees that only qualified users can hold tokens, providing comprehensive protection and compliance throughout the token management process.

Note: Only an issuer admin can deploy a token. For more information, please refer to the Roles and Permissions Guide.

Step by step guide for configuring an ERC-3643 token

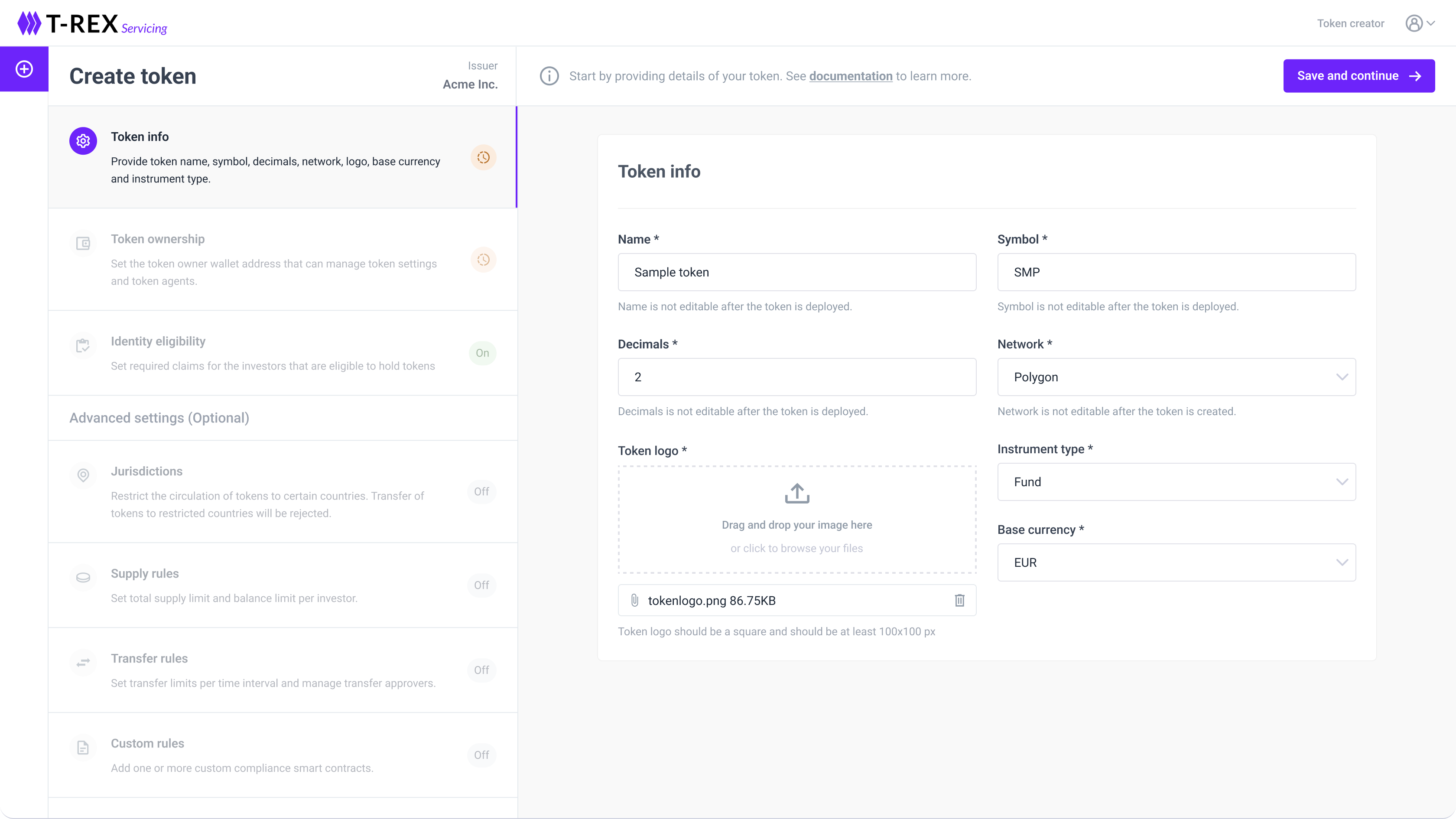

Section 1: Token Info

You can easily manage the fundamental characteristics of your token, including its name, symbol, base currency, instrument type, and logo. These details are pivotal in establishing your token’s identity, usability, and market recognition. Key functionalities include:

- Name and Symbol: Define the unique name and symbol that represent your token in transactions and exchanges.

- Decimals: Set the decimal precision for your token, crucial for defining its divisibility and granularity in transactions. The maximum number of decimals supported is 18. Note that decimals cannot be updated after deployment.

- Network: Specify the blockchain network on which your token operates, ensuring compatibility and functionality within your chosen ecosystem. If you want to operate in a not supported network, please contact our customer success team. Our platform can easily support any EVM network.

- Token logo: Upload a logo that visually represents your token, enhancing its visibility and brand recognition.

- Base Currency: Designate the base currency against which your token’s value is calculated or pegged.

- Instrument Type: Classify your token according to its intended use or function within your project or ecosystem: Fund, Equity, Debt, Commodity, Stable coin or Other.

Our platform supports saving drafts of your token configuration before deployment. This feature enables you to iteratively refine and finalize all aspects of your token’s information, ensuring that every detail aligns with your strategic objectives and regulatory compliance requirements.

- Before Deployment: Edit all fields except for the Network setting. You can save drafts to refine your configuration.

- After Deployment: Off-chain fields remain editable, but on-chain fields Name, Symbol, Network and Decimals are not editable.

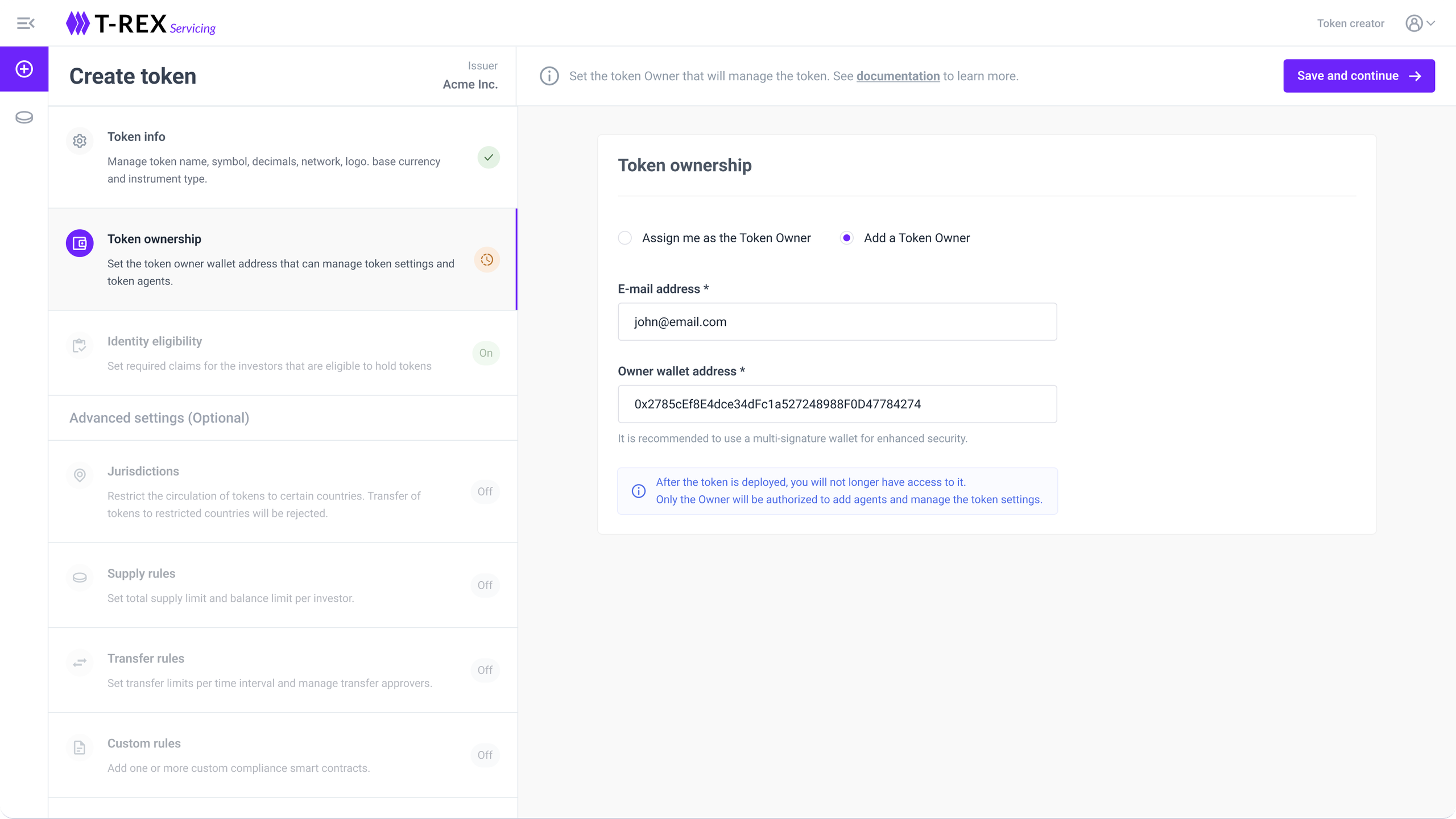

Section 2: Token Ownership

The Owner Wallet Address is the sole authorized wallet capable of adding agents to the token and managing its settings. This privileged role ensures that only authorized parties can administer critical aspects of the token's functionality, including governance, permissions, and operational configurations.

Once the ownership transfer has been completed, the new owner will receive an email notification to access the platform.

- Change ownership (before deployment) → Change the ownership of the token from your account's wallet to another wallet. This action allows you to continue editing token settings until deployment. Once deployed, however, you will no longer retain access to the token.

- Transfer ownership (after deployment) → Transferring ownership means assigning ownership of the token to another wallet address. This action permanently removes your ability to manage agents and token settings using your current wallet. You can do it contacting customer support.

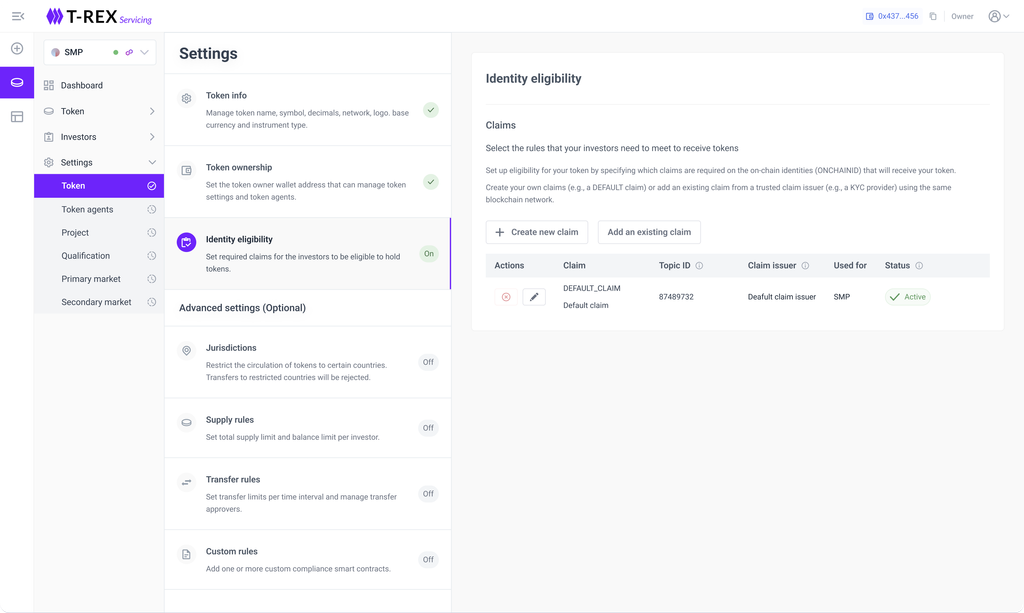

Section 3: Identity Eligibility

Here you configure eligibility for your token by defining which claims are expected to be found on the onchain identities (ONCHAINID) that will receive your token. These claims will match the ones to be issued to those onchain identities when qualifying an investor.

- Create new claim → e.g. a KYC claim.

- Add an existing claim → you can reuse claims from other tokens created by you or another account belonging to your same organization. By choosing this option, you are actually setting same identity eligibility rules of those other tokens. This is useful if you have the same KYC requirements for all your tokens, for example.

Warning: When creating a token a new KYC “DEFAULT_CLAIM” is selected by default. You can edit or remove and add a new one.

Info: At least one claim needs to be selected.

Note: To learn more about KYC statuses and providers you can visit the article Gaining Insight into the KYC.

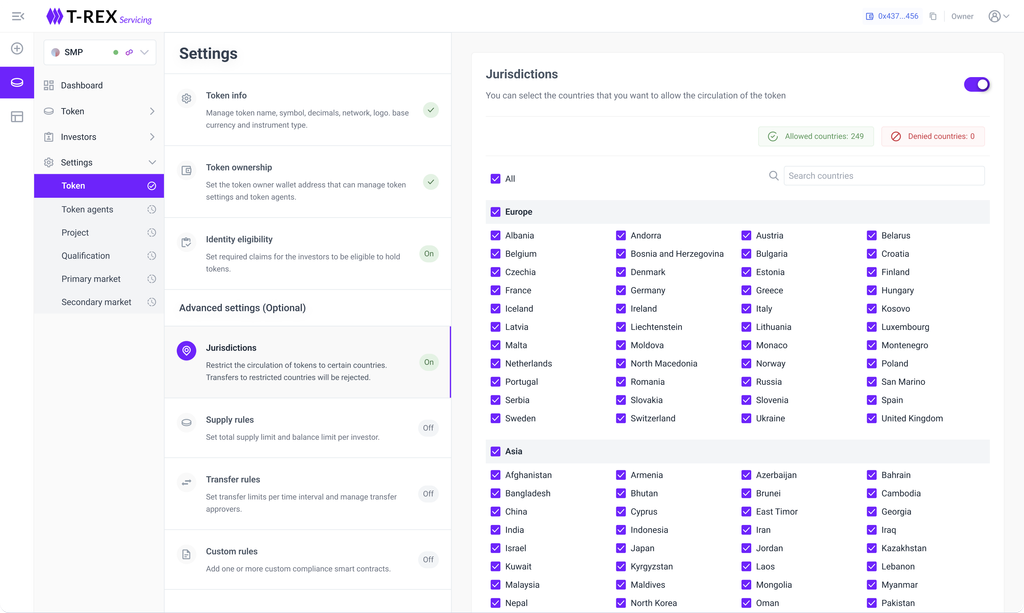

Section 4: Jurisdictions

Limit token circulation to certain countries by creating a list of approved countries. Any transfer will be rejected if the recipient is not a resident of one of those countries.

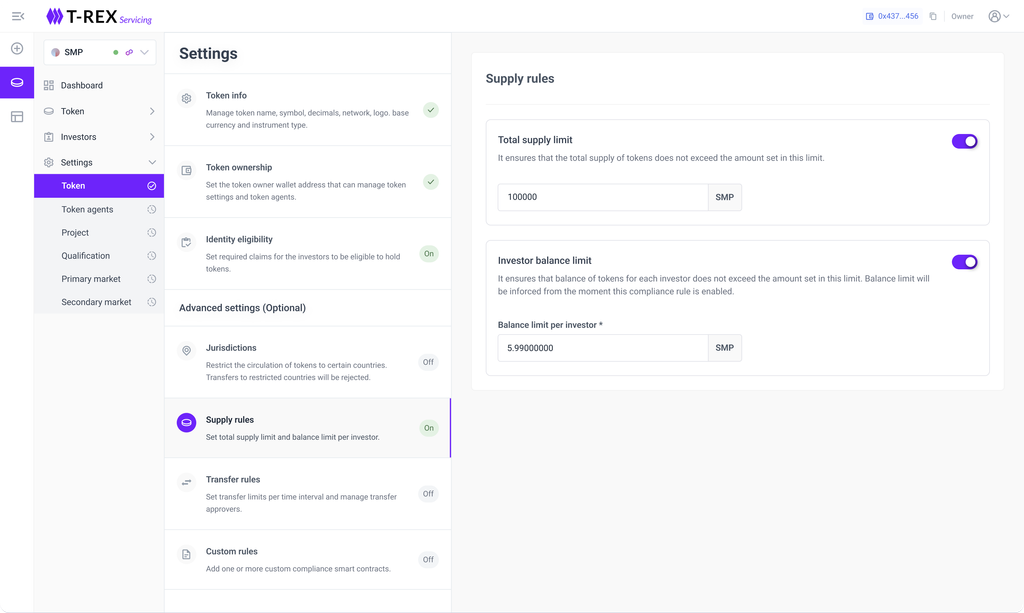

Section 5: Supply rules

These supply rules are essential for maintaining control over the issuance and distribution of tokens, ensuring both regulatory compliance and the integrity of your token economy.

- Total Supply Limit: The Total Supply Limit is a feature that ensures the total number of tokens issued on the platform does not surpass a predefined cap. This limit is fundamental for controlling the overall token supply, providing a safeguard against inflationary pressures and maintaining the value of the tokens.

- Investor Balance Limit: The Balance Limit per Investor feature restricts the maximum number of tokens that any single investor can hold. This rule is vital for ensuring a fair distribution of tokens among investors and for preventing excessive concentration of token ownership.

For example, for a REIT to maintain its favorable tax status, it must comply with 5/50 rule restrictions. It means no more than 50% of a REIT’s shares from being owned by five or fewer individuals.

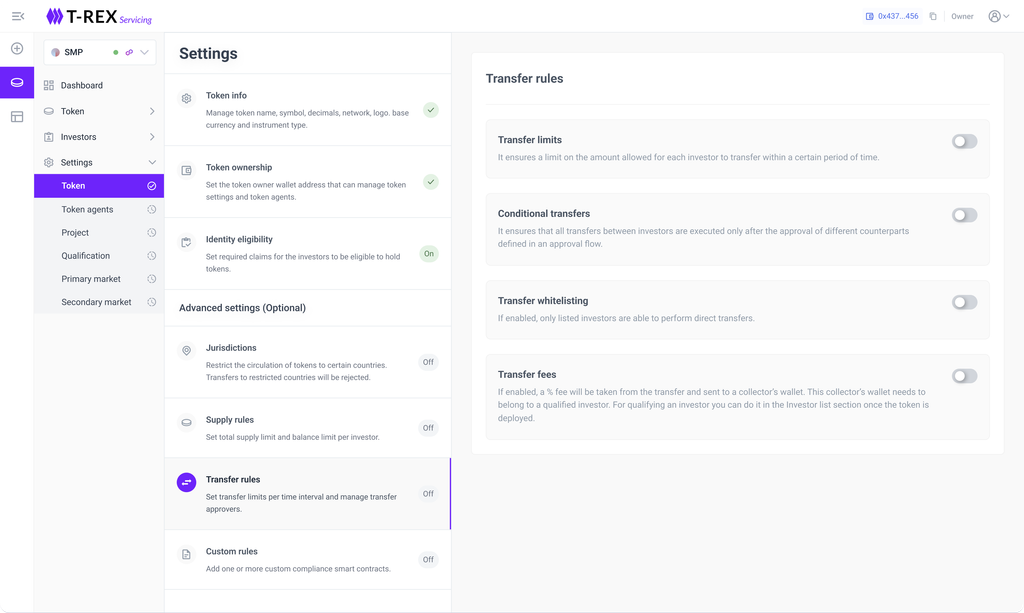

Section 6: Transfer rules

Any transfer rule can be applied to tokens, defining when and how they can be transferred to ensure automation and compliance. This section highlights the rules available on our platform for direct setup, including transfer limitations, conditional transfers, transfer whitelists, and transfer fees. Additionally, any custom rules can be added to meet different needs of business cases, as you will explore in Section 7.

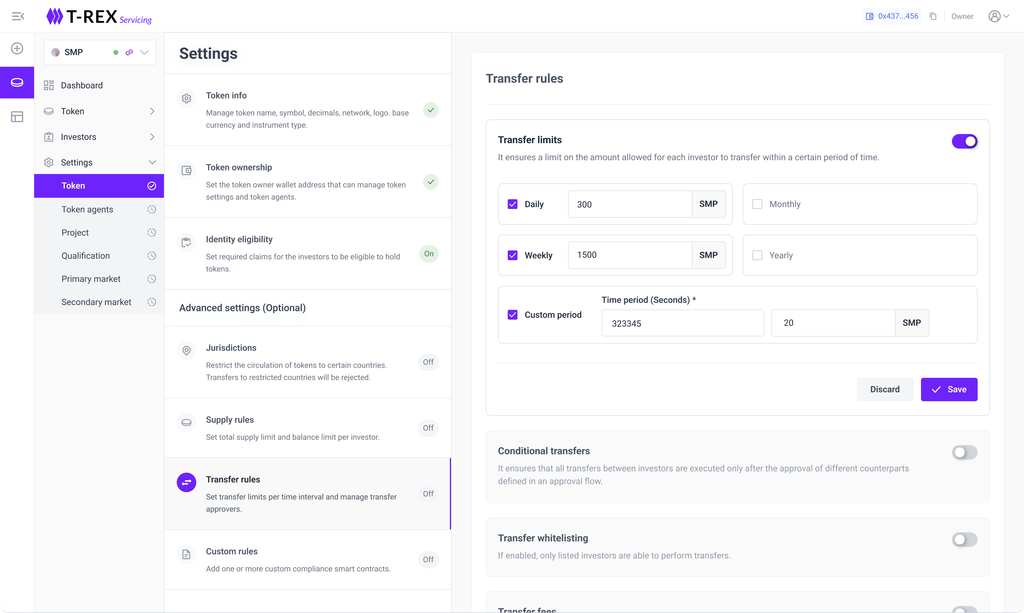

Transfer Limits

The Transfer Limits feature is designed to control the volume of funds that each investor can transfer within specified time intervals. Up to four distinct timeframes can be configured:

- Daily Limits: Sets a cap on the maximum amount an investor can transfer in a single day.

- Weekly Limits: Restricts the total amount transferable over the course of a week.

- Monthly Limits: Defines the upper limit for transfers for 30 days after the limit is set.

- Yearly Limits: Establishes a ceiling on transfer amounts for 1 year after the limit is set.

- Custom Period Limits: Allows for the definition of unique timeframes tailored to specific business needs or regulatory requirements, providing additional flexibility.

These intervals can be tailored to meet the needs of different investment profiles and regulatory requirements, providing flexibility and control over the flow of funds.

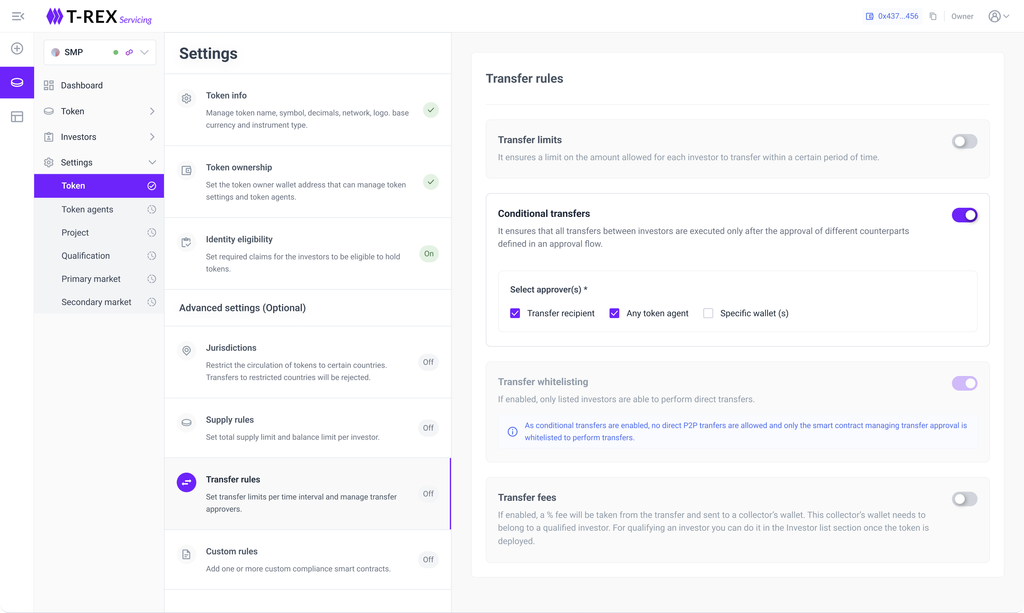

Conditional Transfers

Conditional Transfers, when enabled, ensure that any transfer of funds between investors is subject to an approval process involving multiple stakeholders. This feature adds a layer of security and oversight by requiring designated counterparts to approve the transfer before it can be completed. The approval flow typically involves:

- Request Submission: the initiating investor submits a transfer request.

- Approval Chain: the request is routed through a predefined chain of approvers, which may include compliance officers, fund managers, or other designated parties.

- Final Execution: the transfer proceeds only after all necessary approvals have been secured.

This process minimizes unauthorized transactions, helps prevent fraud, and ensures that all transfers comply with internal and regulatory policies.

Important: Conditional Transfers could be only configured after deployment.

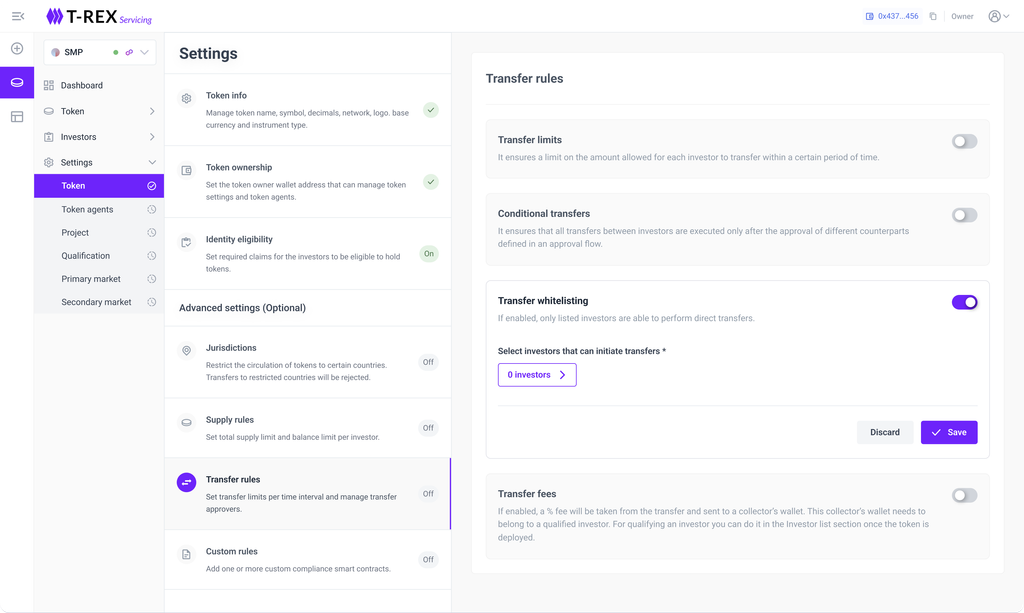

Transfer Whitelisting

With Transfer Whitelisting, only investors who are explicitly listed on the whitelist can initiate transfers. This feature enables controlling who can initiate token transfers, adding another layer of security. Key aspects include:

- Whitelist Management: Administrators can add or remove investors from the whitelist based on compliance and operational criteria.

- Receiving Transfers: Any investor, regardless of their whitelisting status, can receive transfers as long as they fulfill the platform’s compliance requirements.

This selective enabling of transfer capabilities helps to manage risk and ensures that only trusted participants can initiate token movements.

Warning: By enabling conditional transfers trasnfer whitelisting is automatically disabled as all transfer will follow the approval flow defined.

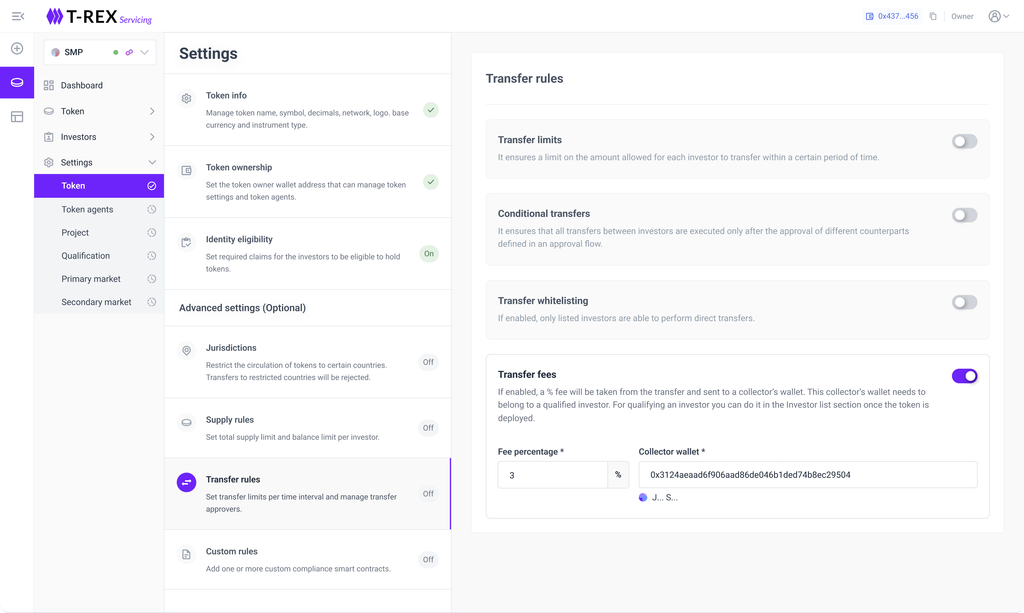

Transfer Fees

The Transfer Fees mechanism enables the platform to charge a percentage-based fee on each transfer. The sender is required to pay the total of the transfer amount plus the fee. For example, if the sender wishes to transfer 100 tokens with a 2% fee, they will need to spend 102 tokens in total.

- Fee Percentage: The fee is calculated as a percentage of the transfer amount and can be customized according to different investor profiles or transaction types.

- Collector’s Wallet: The wallet where the fees are collected must belong to a qualified investor, ensuring compliance with regulatory and operational standards.

This system not only generates revenue for the platform, but also ensures that all fee transactions are transparent and compliant.

Info: For detailed information on how our platform's Enhanced Subscription Model integrates advanced investor input options and diversified fee structures, refer to our article on Fee Inputs and Schema.

Important: Transfer Fees could be only configured after deployment.

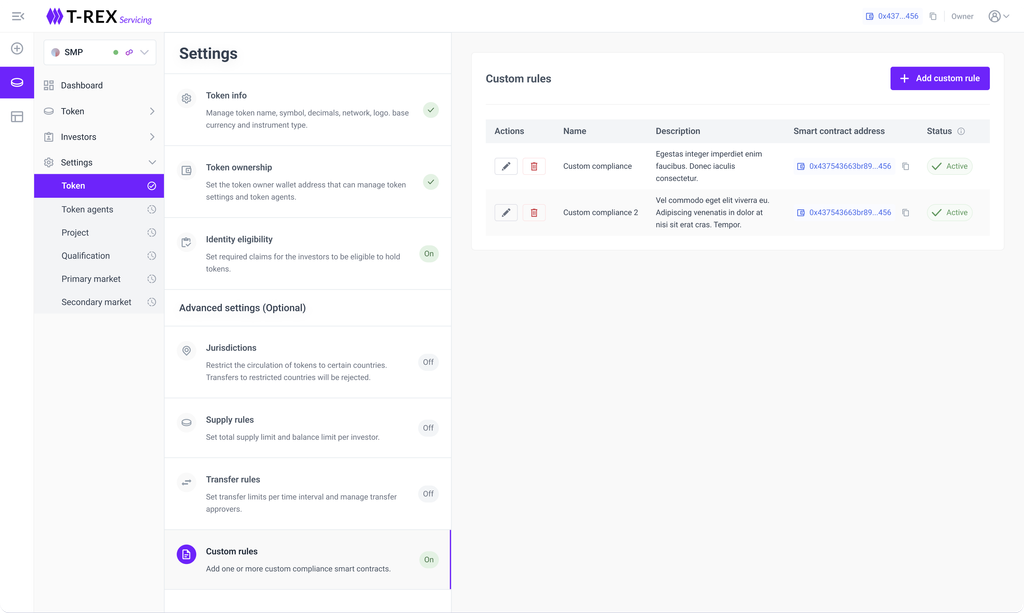

Section 7: Custom rules

Custom compliance smart contracts allow you to define and enforce unique rules that go beyond standard platform functionalities.

- Custom Rule Name: Define a descriptive name for each custom compliance rule, reflecting its purpose and function within your token ecosystem.

- Custom Rule Description: Provide a detailed explanation of each custom rule, outlining its specific conditions and regulatory compliance objectives.

- Smart Contract Address: Once added, the smart contract address serves as the immutable identifier for each custom compliance rule. This address is not editable, ensuring the integrity and security of the compliance framework.

Warning: If you'd like to create a custom rule, please reach out to our Customer Support team with the details and use case. We'll be happy to help guide you through the implementation process.

Deploy the token

After completing the configuration process, users have the option to either save the token as a draft—allowing for future edits and deployment—or proceed with immediate deployment to their selected network. This flexibility ensures that any necessary adjustments can be made before deploying the token.

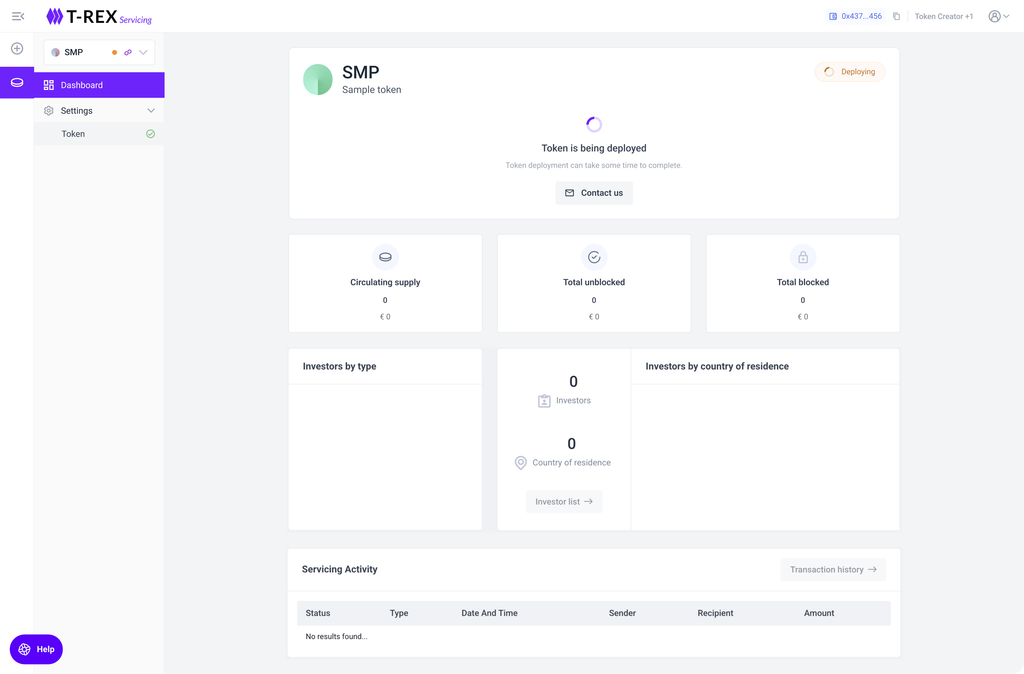

When you click Deploy, you will first see a Deploying status, indicating that the ERC-3643 smart contracts are being deployed through the ERC-3643 Factory. During this process, the system is executing the deployment of all necessary smart contracts on the blockchain. Once the deployment is complete, you will receive an email notification confirming that your token has been successfully deployed.

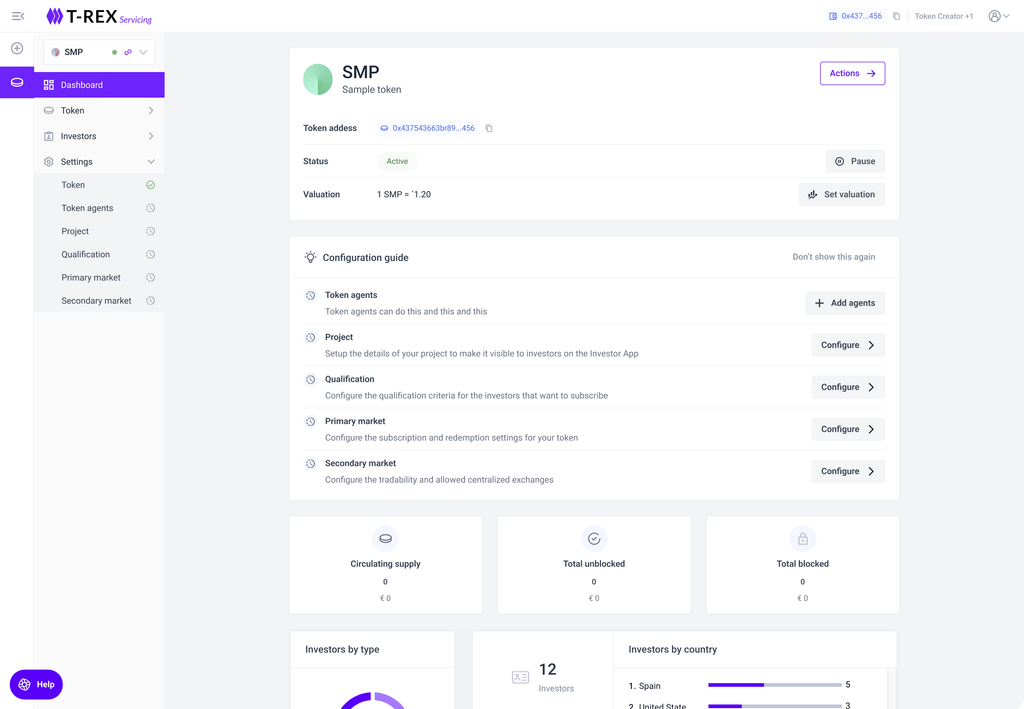

After deployment, the issuer is redirected to an intuitive dashboard where they can monitor key metrics and performance indicators. You also have a Configuration guide here, where you can easily access to the next steps needed to configure your token, add token agents, create projects, and access to configure primary and secondary market. As mentioned earlier in the article, once the token is deployed, you can effortlessly modify compliance rules without the need to redeploy or migrate the smart contract. This flexibility ensures agility, allowing you to quickly adapt to the ever-changing regulatory landscape.